Special Senior Property Tax Exemption for Jefferson County

Many seniors age 65 and over are not aware of Alabama Act 2021-300 passed by the legislature in April of 2021:

In Jefferson County, a person age 65 or over may claim a senior property tax exemption for ad valorem tax purposes on real property in the county owned by the person and classified as single-family owner-occupied residential property and used as the principal place of residence of the person for not less than five years immediately prior to the tax year for which the person first claims the senior property tax exemption. The senior property tax exemption shall freeze the assessed value of the property for the year immediately prior to claiming the exemption. The taxpayer shall continue to be eligible for the senior property tax exemption as long as the taxpayer continues to use the property as his or her principal place of residence.

While the assessed value is frozen, the property will continue to be subject to any millage rate increases. Also, any additions to the property would be added to the assessed value.

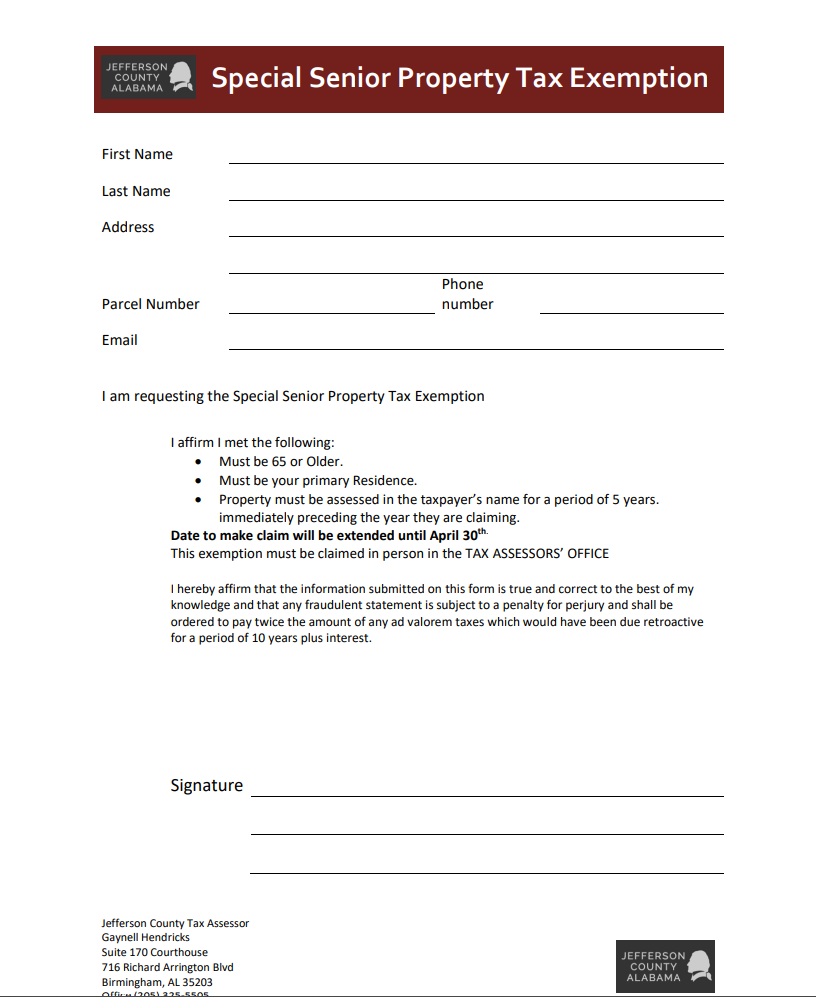

If this applies to you, please note the filing deadline was extended to April 30th.

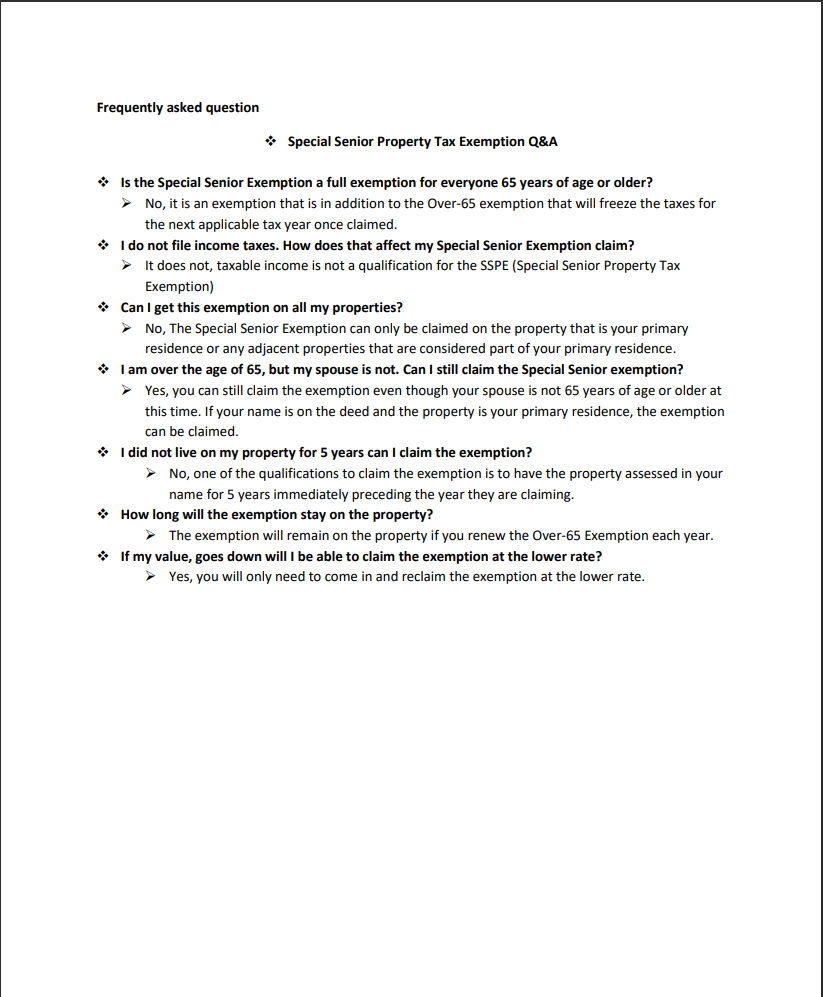

Click here for the Jefferson County website with the application form and FAQs or find them below to download.

To apply for the Special Senior Property Tax Exemption, you must do so in person at the Jefferson County Courthouse or at the Bessemer Division.

Jefferson County Tax Assessor – Room 170

716 Richard Arrington Jr. Blvd N

Birmingham, Alabama 35203 Phone (205) 325-5506

Bessemer Division

Room 209 Courthouse

Bessemer, Alabama 35020 Phone (205) 481-4126

As always, please contact your Dent Moses advisor if you have questions.