A Better Way to Make Federal and State Tax Payments?

By: Lane Hooper, CPA, Senior Accountant

Since the pandemic began, the Internal Revenue Service has struggled to process returns, payments and correspondence. See our July 13th post (link here) if you’d like to read more in depth about the current state of affairs at the IRS. If one of our clients experiences an IRS issue, it’s very difficult to resolve. Alabama still answers the phones and generally are very helpful.

In the past, we would occasionally see payments to the IRS misapplied – namely estimates. We’re now seeing an increase in this as well as a rash of uncashed estimated checks. We have numerous clients who mailed 4th quarter estimates in January 2021 and the checks have still not cleared as of the end of September. Certainly, there have been issues with the mail, but our guess is the IRS received the payments.

Several years back the IRS and State of Alabama mandated that businesses pay most taxes electronically which has greatly reduced errors and related notices. While individuals are not required to make electronic payments, you can choose to do so. The following are electronic alternatives to paying federal and state estimates by check.

Direct Deposit

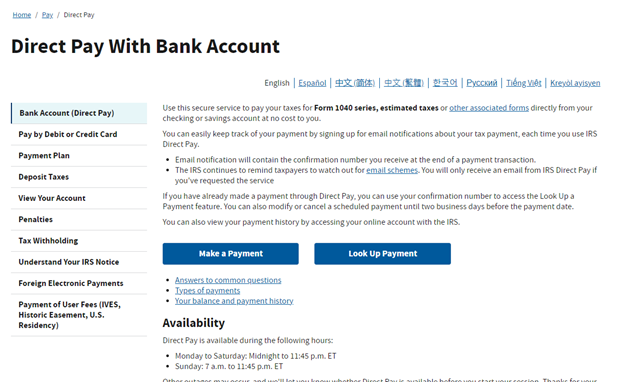

Direct Pay through the IRS website is an option for individuals to payments directly from their bank accounts, which can be accessed here. You will be linked to the web page pictured below.

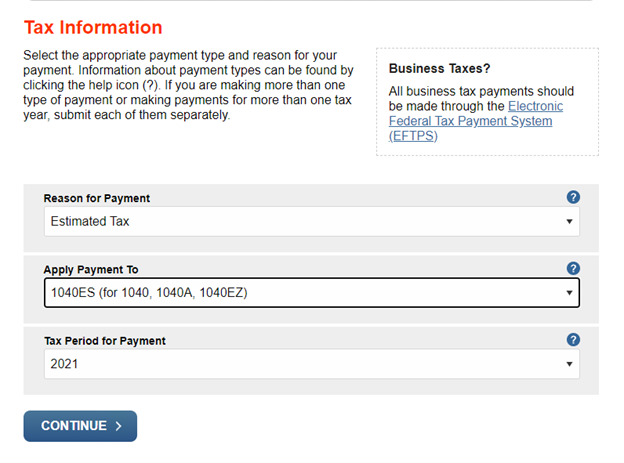

Payments can be made for estimates, balances due, or a variety of other reasons. Simply select “Make a Payment” and select from the three dropdown lists on the following page, pictured below.

From there you will be prompted to enter your personal info (name, filing status, SSN, etc.). After entering personal info, you will be asked to input bank account information.

Debit or Credit Card

The IRS also allows individuals to pay directly with a debit or credit card. Click here to access the debit/credit card payment portal with the IRS. Keep in mind there are fees associated with using a debit or credit card. Credit card fees are approximately 2%.

Electronic Federal Tax Payment System (EFTP)

Another easy option for paying your individual OR business taxes is through the Electronic Federal Tax Payment System (EFTPS) offered by the Treasury Department. Individuals and businesses must first complete a simple enrollment form and are then able to make payments.

Some of the added benefits of EFTPS are the abilities to schedule payments in advance, track payments, view payment history, and more.

To access EFTPS click here and select “enroll” or “make a payment” (once you are enrolled).

For our Alabama clients, there have been some updates to the My Alabama Taxes (MAT) website that allow for easier payments. The following link will take you to MAT’s home page. From there you can create an account and make direct payments. MAT also allows you to check refund status and payment history.

Please contact your Dent Moses advisor or our office with questions or for more information.