UPDATED: Alabama Department of Labor Releases Summary of COVID-19 Benefits Available

Included in this post is the CARES Act and Unemployment Insurance Frequently Asked Questions as well as a COVID-19 Benefits Available – PDF table available here or at the bottom of the article.

UPDATED April 13, 2020 via information released from the Alabama Department of Labor. Information is updated frequently. Please check back here for updates.

Alabama to Begin Processing Claims Under CARES Act Provisions

(Pandemic Unemployment Assistance and Pandemic Emergency Unemployment Compensation Programs)

On March 27, 2020, Congress passed a federal stimulus package known as the CARES Act, or the Relief for Workers Affected by Coronavirus Act. Within this act are three benefits that unemployed individuals may be eligible for. These benefits are outlined below, and additional questions are answered throughout this document. Also please see the attached pdf.

On April 13, 2020, Alabama Department of Labor Secretary Fitzgerald Washington announced that Alabama will begin processing unemployment compensation claims under all programs created by the passage of the federal CARES Act.

Programs included in the legislation:

ADDITIONAL FEDERAL UNEMPLOYMENT COMPENSATION (FPUC)

This emergency benefit provides most individuals an emergency increase in traditional unemployment insurance benefits of $600 per week for eligible weeks beginning March 29, 2020 through July 25, 2020. This may also be referred to as a stimulus benefit. *Alabama began paying these benefits on April 8, 2020.

PANDEMIC UNEMPLOYMENT ASSISTANCE (PUA)

This emergency benefit provides up to 39 weeks of unemployment insurance benefits to people not otherwise eligible for regular unemployment, including the self-employed, gig economy workers, independent contractors, church employees, nonprofit and government employees, and those who have exhausted their regular and extended benefits. This benefit is retroactive to January 27, 2020. *Alabama will begin processing these claims effective April 13, 2020.

PANDEMIC EMERGENCY UNEMPLOYMENT COMPENSATION (PEUC)

This benefit provides an additional 13 weeks of emergency unemployment insurance for people who remain unemployed after they have exhausted their traditional unemployment benefits. *Alabama will begin processing these claims effective April 20, 2020.

Workers who became unemployed as a direct result of COVID19 Pandemic (DR-4503 or EM-3472) may qualify for this unemployment assistance.

Federal Pandemic Unemployment Compensation: People who live in or worked in Alabama and became unemployed due to the COVID-19 Emergency Declaration during the period of January 20, 2020 and continuing, may also be eligible for assistance under the Federal Pandemic Unemployment Compensation (FPUC) program, which was triggered when President Trump signed into law the Coronavirus Aid, Relief and Economic Security (CARES) act on March 27, 2020.

Pandemic Unemployment Assistance: People who live in or worked in Alabama and became unemployed due to the COVID19 Pandemic during the period of January 27, 2020 and continuing, may be eligible for assistance under the Pandemic Unemployment Assistance (PUA), which was triggered when President Trump designated Alabama as a disaster area on March 29, 2020.

People who may be eligible for Pandemic Unemployment Assistance include individuals not eligible for regular unemployment compensation or extended benefits under state or Federal law or pandemic emergency compensation (PEUC), including:

• the self-employed,

• those seeking part-time employment,

• church employees,

• gig economy workers,

• nonprofit and governmental workers,

• workers who have exhausted regular unemployment compensation benefits,

• individuals lacking sufficient work history, and

• those who otherwise do not qualify for regular unemployment compensation or extended benefits under state or Federal law or PEUC.

Claimants who already filed for PUA may have received a notice stating that they are monetarily ineligible for benefits at this time. However, they may still be eligible for Pandemic Unemployment Assistance (PUA). A document labeled the PUA-D4503-MI, will be mailed to all PUA claimants. Claimants should complete the form with the required documentation as soon as possible in order to complete the processing of the PUA claim. Claimants will not be required to file another claim as ADOL will determine eligibility for PUA based on the information provided to the agency as outlined in the document that will be mailed to claimants.

Further instructions for the self-employed: The self-employed should enter their name as the employer, and use either their address or their business address. Claimants should continue to certify weekly, and once these claims are processed, all eligible weeks will be paid retroactively.

PUA is payable for weeks of unemployment, partial unemployment, or inability to work caused by the COVID-19 related reasons beginning on or after January 27, 2020. PUA is not payable for any week of unemployment ending after December 31, 2020.

Pandemic Emergency Unemployment Compensation (PEUC): The U.S. Department of Labor issued federal guidance late Friday, April 10, 2020 for the Pandemic Emergency Unemployment Compensation (PEUC) provisions of the CARES Act. PEUC provides for 13 additional weeks of unemployment benefits after a claimant exhausts all entitlement to regular unemployment. Once a claimant’s benefit year ceases, they can then establish a new benefit year to requalify for regular unemployment. The weekly benefit amount under the PEUC program is the prior weekly benefit amount plus the additional $600 provided for under FPUC (Max. $875 in Alabama). These benefits will apply once workers have exhausted the 14 weeks of regular unemployment compensation benefits (or 26 weeks for those who filed initial claims prior to January 1, 2020). These benefits are applicable to weeks beginning March 29, 2020 through weeks ending December 26, 2020.

These benefits are 100% federally funded and employers will not be charged for any benefits paid under a CARES Act program.

Claims can be filed through ADOL’s website at www.labor.alabama.gov or by calling 1-866-234-5382. Direct deposit is the fastest method to receive benefits.

CARES Act and Unemployment Insurance Frequently Asked Questions

Topics in this FAQ:

- GENERAL BENEFIT INFORMATION

- ADDITIONAL FEDERAL PANDEMIC UNEMPLOYMENT COMPENSATION (FPUC) BENEFIT INFORMATION

- PANDEMIC UNEMPLOYMENT ASSISTANCE (PUA) BENEFIT INFORMATION

- PANDEMIC EMERGENCY UNEMPLOYMENT COMPENSATION (PEUC) BENEFIT INFORMATION

GENERAL

If I already filed for unemployment benefits do I need to apply again?

If you have applied for or are currently receiving unemployment benefits, you do not need to apply again to access these benefits.

When will these resources be available?

Final federal guidance on how to administer FPUC and PUA was received on April 4 and April 5, 2020 from the U.S. Department of Labor. Final guidance on how to administer PEUC has not yet been provided. We have evaluated this recently received guidance and are actively working on implementing these new programs. These new programs will take time to implement but we are doing so as quickly as possible. Please continue to check this FAQ for the latest information regarding the CARES Act benefits.

ADDITIONAL FEDERAL PANDEMIC UNEMPLOYMENT COMPENSATION (FPUC)

If I have a pending unemployment application, do I need to apply again for the additional $600?

No, if you are currently filing for benefits there is no additional action you need to take beyond filing your weekly claims as long as you are unemployed.

If I am currently receiving unemployment benefits do I need to apply again for the additional $600?

No, there is no additional action you need to take beyond filing your weekly claims as long as you are unemployed.

Will the additional $600 come a different way than my regular unemployment benefit?

No, once the benefit becomes available you will receive it in the same way as you receive your traditional unemployment benefit. You will see two different entries on your statement.

When will I start to see the additional $600 on my unemployment?

ADOL began paying the additional $600 benefit on April 8, 2020. Please note it can take up to 21 days to receive first payments, but all eligible weeks will be retroactively paid, meaning that you could see several weeks’ worth of benefits in one payment.

Will I get an additional $600 for weeks in the past?

The additional $600 will be effective for eligible weeks beginning 03/29/20.

Will any additional income I received through these benefits impact my eligibility for unemployment benefits?

No, funds you receive as a result of this stimulus package will not impact your income eligibility as it is not considered earned income.

PANDEMIC UNEMPLOYMENT ASSISTANCE (PUA)

If I am receiving unemployment benefits am I also eligible for this benefit?

No, this benefit is only considered when an individual is determined to have exhausted regular unemployment benefits and the 13 additional weeks of unemployment you may qualify for through Pandemic Emergency Unemployment Compensation (PEUC).

If I have already applied for unemployment, should I also apply for this benefit?

No, if you are currently filing for or receiving unemployment benefits there is no additional action you need to take beyond filing your weekly claims as long as you are unemployed.

When will I start to get pandemic unemployment benefits and how will I know if I am approved?

We have evaluated recently received guidance from the U.S. Department of Labor and are working now to implement this program. When implemented, PUA will be available to claimants who are not eligible for either regular or PEUC unemployment benefits. Please continue to check this FAQ for the latest information regarding the CARES Act Benefits.

How do I know if I should apply for traditional unemployment or pandemic unemployment?

PUA will be available for claimants not otherwise eligible for regular unemployment, including the self-employed, gig economy workers, independent contractors, church employees, nonprofit and government employees, and those who have exhausted their regular, extended and PEUC benefits. Please continue to check this FAQ for the latest information when this program is fully implemented.

Where can I apply for pandemic unemployment and when will the application be available?

You can file for PUA just like a regular claim – file online at www.labor.alabama.gov or by calling 1-866234-5382. Online filing is strongly encouraged.

What information will I need to provide to be able to apply for benefits?

It is recommended you have the following information when you file:

- Your Social Security Number

- The names of all employers as they appear on your pay stub with the dates worked for all employers since October 1, 2018

- Wage information, including your latest tax information. If you have not yet filed your 2019 tax return, you will need your 2018 tax return information.

- Your State Driver’s License or Identification Card number, if you have one

- Your Alien Registration Number, if you are not a U.S. citizen but are legally authorized to work in the United States

- If you have any non-Alabama employers, you must have an accurate mailing address and phone number for them

- If you are self-employed, you may be asked to provide details regarding your business. This may occur after you file your initial application.

If I do not provide accurate information on my application, will I have to repay benefits received? Yes. As with any unemployment claim, you are required to provide accurate information or face penalties including denial of benefits and repayment of benefits.

PANDEMIC EMERGENCY UNEMPLOYMENT COMPENSATION (PEUC)

If I have a pending unemployment application do I need to apply again for the additional 13 weeks?

No, if you are currently filing for and receiving unemployment benefits there is no additional action you need to take beyond filing your weekly claims as long as you are unemployed.

If I was receiving unemployment in the past and I used up all of my eligible weeks, do I need to reapply for unemployment benefits?

The 13-week extension of benefit is effective for any unemployment insurance claims weeks filed after 03/29/20. At this time, we are working to implement the PEUC program and are unable to process any weeks of extensions while reprogramming our system. We encourage you to continue to check this FAQ for regular updates.

When will I begin to receive my 13 weeks of extended unemployment benefits?

PEUC benefits will begin after you have exhausted all weeks of regular unemployment benefits. While the law has been passed by Congress, the U.S. Department of Labor must provide guidance to all states on the proper administration of the program and how to properly draw down the additional federal funds. We have not yet received that guidance. Once received, the division will have to build and deploy the program for Alabama. We encourage you to continue to check this FAQ for regular updates.

If I was on unemployment benefits in the past, but am currently employed, should I apply for the additional 13 weeks?

No. This benefit provides an additional 13 weeks of emergency unemployment insurance for people who remain unemployed after they have exhausted their traditional unemployment benefits. Because you are employed, you do not qualify.

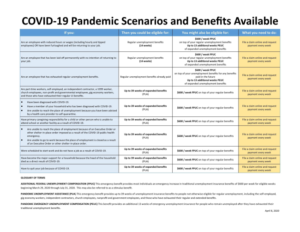

COVID-19 Pandemic Scenarios and Benefits Available

Click here or image to view.

Important note: None of the benefits described above, nor unemployment benefits of any kind, are available to employees who quit without good work-related cause, refuse to return to work, or refuse to receive full-time pay. Refusing to return to work could result in a disqualification for benefit eligibility. Attempts to collect unemployment benefits after quitting a job without good work-related cause is considered to be fraud. The CARES Act specifically provides for serious consequences for fraudulent cases including fines, confinement, and an inability to receive future unemployment benefits until all fraudulent claims and fines have been repaid. Employers are encouraged to utilize the New Hire system to report those employees who fail to return to work.

Updated by ADOT on August 8, 2020.