Putting a Dollar Value on Your Most Valuable Asset

Ask an employer the compensation for a given employee and you’ll likely hear something like “$15 an hour” or “$50,000 a year.”

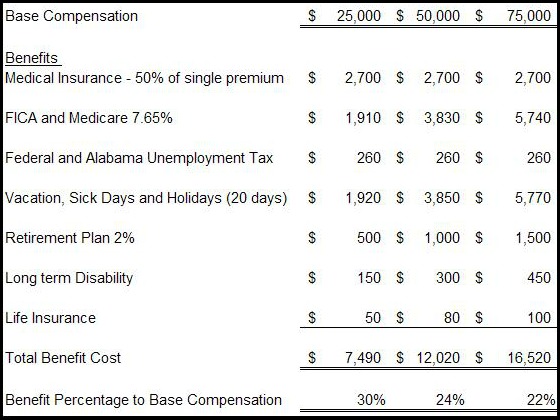

Of course the dollar figure is correct. But it represents only about 75-80% of total compensation. That’s because the hourly rate or base pay is just the starting point. While many industries track the cost or “burden” of an employee, many costs get buried and are not included in the equation.

Do you know what you’re really spending to maintain your workforce? Read on to learn about hidden costs you may not be considering and your employees may not be aware of.

- Medical Insurance. Most employers pay a portion of single medical coverage with very few picking up the tab for the entire family. A typical monthly premium for an individual is about $450, so let’s say you pay for 50% or $225 per month or $2,700 annually.

- Payroll taxes. The combination of FICA (6.2%) and Medicare (1.45%) known as payroll taxes is non-elective and certainly one of the biggest employee costs. This tax is paid equally by the employee and the employer, with the employer’s share at 7.65% of compensation up to $117,000. While many employers do not consider payroll taxes a benefit, the employee does profit by drawing Social Security and by using Medicare from retirement until death, or at least as long as the funds last!

- Unemployment taxes. Federal and Alabama unemployment taxes are capped at about $260 per employee per year. Like payroll taxes they’re mandatory, but can provide a benefit to an employee.

- Vacation, sick days and holidays. This is a big potential employer expense, especially when employees who produce goods or bill by the hour are out. Two weeks of vacation, three sick days and seven holidays adds up to 20 days off annually. And some businesses observe additional holidays. Depending on the employee’s contribution and the ability of others to cover, it may be necessary to bring in a temp or pay overtime to cover absences.

- Retirement Plan. Most employers offer some type of retirement plan. An example is a simple 401(k). An employer who contributes 2% of covered compensation for all eligible employees would be contributing $1,000 for an employee earning $50,000 per year.

- Long-term disability. Long-term coverage can be costly, as the risk of disability is much higher than the risk of premature death. The cost of both premium and benefit is based on salary. For employees earning $50,000 and $75,000 the annual cost of providing disability would be approximately $300 and $450, respectively.

- Life Insurance. While ensuring employees’ lives is not a big expense, it certainly is a sizable benefit for survivors if the employee passes away while in your employment. Group coverage cost varies by age. The price of providing $100,000 of coverage for a 40-year-old is about $100 per year.

Here is an example:

Wait, wait there’s more.

When calculating the cost of housing and feeding an employee, you can’t forget the extras. Like birthday bagels, occasional meals to recognize achievement and, of course, the annual Christmas party, gift or bonus. Just providing coffee, soft drinks and snacks can add $1 to $2 a day to the cost of carrying an employee – that’s $250 to $500 annually per person.

While I do not advocate pinching every penny or asking employees to pay for their own Mountain Dew, I do advise getting a firm handle on how these and other incremental expenses add up.

Doing this certainly gives you an idea of your true costs. But there’s more to it than that. Some savvy business owners share this information with employees in an annual employment letter. This underscores that the dollar figure on the contract does not represent all that an employee is getting. Describing the full compensation package also communicates that employees are valued, and that investing in them is a core value.

It’s your money.

That payroll line item on your budget is a familiar number. But in order to really understand how much you’re spending you’ve got to dig a little deeper. Take the time to uncover all the expenses and look at them as an aggregate. You’ll never regret knowing the real story about where your money is going.