Cost Segregation Studies: Maximize the Tax Benefits of your Real Estate

Here’s a crazy irony for you. Non-residential real property is deductible over 39 years. So by the time most dentists are able to purchase real estate, they are typically unable to reap the full tax benefits of ownership during their working years.

One way to capture these tax benefits sooner is to have a cost segregation study performed on your building. The goal is to identify structural elements that fall into a category of assets that may be deducted over a shorter period of time. Dental equipment and land improvements, for example, may be deducted over 5 years and 15 years, respectively.

A cost segregation study does not identify new deductions. But it can accelerate those deductions so that you may more quickly realize the tax benefits of your investment.

The $118,000 Tax Refund!

Last year, a doctor invested $955,000 in the construction of a dental office. As a result of a cost segregation study he was able to assign 20% of his investment to dental equipment and another 21% to land improvements.

Had the study not been done, the entire investment would have defaulted to non-residential real property. That’s the type that’s deductible over 39 years.

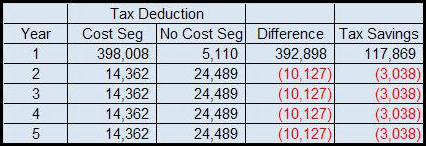

This chart summarizes the results with and without the study and the first year tax savings:

Two factors contribute to the large disparity in the first year. Not only do we have the shortened depreciable lives working in the doctor’s favor, but the doctor also benefits from the availability of Section 179 business expensing on the 5-year and 15-year property. Bottom line – the doctor gets a first-year deduction for the entirety of the costs assigned to these categories.

Incidentally, in this example the estimated $118,000 in tax savings wiped out nearly all of the doctor’s tax liability for the year – an attractive trade-off!

The Bottom Line

As you can see from the example, the greater the investment, the greater the potential first year tax savings from a cost segregation study. But this does not mean you have to spend $1 million on your building to justify a study.

Firms that perform these studies will provide a price for the study and an estimate of tax savings before receiving a commitment from the doctor. If the estimated tax savings is a healthy multiple of the price of the study, the cost is easy to justify and is, in fact, a wise investment.